Protecting Your Loved Ones For Lifetimes

We're here for you. Comprehensive and affordable estate and financial planning.

We are Arizona’s #1 estate-planning company, trusted by over 40,000 local clients. From Phoenix to Tucson and everywhere in between, we help families avoid probate and protect their assets with a complete estate risk management plan built around a properly funded Living Trust.

Who Really Decides What Happens to Your Assets?

Two Easy Ways to Protect Your Estate

Schedule a Free Consultation

Sit down with one of our estate planners for a one-on-one conversation about your family, your goals, and what an estate plan should look like for you.

Start with a ConsultationAttend a Free Local Seminar

We host free estate planning workshops across Arizona where we break down the dangers of probate and how to avoid them.

Meet the Attorney We Partner With

Clint Smith

Estate Planning Attorney

- Licensed Arizona attorney since 1985

- Author of Estate Planning: A Plain English Guide to Wills and Trusts

- ASU Sandra Day O'Connor College of Law

“I've been offering peace of mind to Arizona families since 1985. I graduated from ASU's Sandra Day O'Connor law school in Tempe, Arizona in 1985 and have practiced in the East Valley, including Mesa, Apache Junction, Queen Creek, Gilbert and now Scottsdale, ever since.

I spent decades in courtrooms, helping people with financial difficulties, and in 2010 began my transition into estate planning. Now, I help my clients stay out of legal trouble and give their loved ones a precious gift: an estate plan that will keep their affairs out of court.”

Meet Our Team

Our Mission

Standing by You Through Life's Hardest Moments

Empathy and expertise to guide your family through life's most difficult times.

There is the pain of losing someone you love. It's profound and life-altering. But even deeper is the anguish of witnessing someone dear suffer, whether from the slow decline of ALS, cancer, or Alzheimer's.

And then, there's the pain that feels utterly unbearable. The loss caused by something preventable: reckless behavior, addiction, or a tragic accident.

At RJP Estate Planning, we understand that grief, no matter its cause, is excruciating. We've learned, through our own experiences and those of the families we serve, that there's one thing that can help ease the burden: helping others.

“Healing begins with action, and at RJP Estate Planning, helping others is at the heart of everything we do.”

What Drives Us

Protect Your Family's Financial Future

We provide thoughtful, personalized strategies to ensure your loved ones are financially secure, no matter what life brings.

Simplify the Estate Planning Process

Our mission is to make estate planning straightforward, so you can focus on what matters most: your family.

Prevent Avoidable Hardships

We are dedicated to helping you minimize risks and protect your legacy from unnecessary complications.

Our Commitment to Helping Families

For over 30 years, we've stood alongside families during their most challenging moments, helping them navigate grief, protect their legacies, and avoid financial hardship.

Understanding Your Needs

We take the time to listen and learn about your family's unique situation, ensuring that every plan is tailored to your goals.

Developing Comprehensive Plans

From trusts to wills, our estate plans are designed to protect your loved ones and provide peace of mind for generations.

Minimizing Risks

Our team identifies potential risks and develops strategies to safeguard your assets from unnecessary complications.

Standing by You Every Step

We are here to guide you through the estate planning process and provide ongoing support when you need it most.

A Complete Estate Plan Includes

Living Trust

The foundation of your estate plan. Holds your assets, avoids probate, and ensures a smooth transfer to your beneficiaries privately and on your terms.

Pour-Over Will

A safety net that captures any assets not already in your trust and directs them into it, ensuring nothing is left out.

Financial Power of Attorney

Appoints someone you trust to manage your finances, pay bills, and handle transactions if you become unable to do so yourself.

Medical Power of Attorney

Designates a trusted person to make healthcare decisions on your behalf when you can't, ensuring your wishes are honored.

Our Services Also Include

Financial planning tailored to your goals.

Managing wealth is more than just investments. At RJP, our private wealth management is just the start. We offer a complete suite of financial services to protect, grow, and organize every part of your financial life. From retirement planning and risk management to insurance and legacy strategies, we keep your future secure and your options clear. Discover how simple it is to have all your financial needs met in one place.

Protect What You've Built

Risk

Management

You worked decades to build your wealth. The right plan makes sure nothing takes it away.

From market downturns and rising healthcare costs to tax changes and gaps in your estate plan, the threats to your financial security are real and constant. We identify the vulnerabilities in your current plan and build layered protection around everything that matters most.

Asset Protection

Shield your wealth from creditors, lawsuits, and unexpected claims with trust structures and legal safeguards.

Market Volatility

Protect your portfolio from downturns with diversification strategies and withdrawal plans designed for turbulent markets.

Tax Exposure

Reduce your tax burden across retirement accounts, Social Security, and capital gains with proactive planning strategies.

Long-Term Care

Plan for the healthcare costs that Medicare does not cover, including assisted living, nursing care, and in-home support.

The Threats Most People Don't Plan For

Your wealth faces more risks than just a bad market year. From estate planning gaps and tax changes to healthcare costs and inflation, the threats are real, constant, and often invisible until it is too late.

Outdated or Missing Estate Plans

An estate plan that has not been updated in years can leave your family exposed to probate, unnecessary taxes, and assets going to the wrong people. Life changes faster than most plans do.

Market Downturns at the Wrong Time

A major market drop in the first few years of retirement can permanently damage your portfolio. This "sequence of returns risk" means timing matters just as much as total returns over a lifetime.

Rising Tax Exposure

Tax laws change constantly, and the wrong withdrawal strategy can cost tens of thousands in unnecessary taxes. Required minimum distributions, capital gains, and Social Security taxation all add up quickly.

Long-Term Care Costs

There is roughly a 70% chance someone over 65 will need some form of long-term care. A semi-private nursing home room runs over $9,000 per month, and Medicare does not cover it.

Inflation Eroding Your Wealth

At 3% inflation, your purchasing power drops nearly in half over 20 years. Healthcare, insurance, and utilities rise even faster, making a comfortable retirement feel tight without adjustments.

Losing a Spouse or Partner

When a spouse passes, the surviving partner often loses a Social Security check, faces higher tax brackets as a single filer, and may need to cover costs that were previously shared.

Layered Protection for Every Angle

There is no single solution that covers everything. Real risk management means building multiple layers of protection, each one designed to address a specific vulnerability in your financial picture.

Trust & Entity Structures

Revocable and irrevocable trusts, LLCs, and family limited partnerships can shield your assets from creditors and probate while maintaining the control you need.

Keeps your estate private, avoids court involvement, and protects assets across generations.

Diversification & Withdrawal Planning

We structure your portfolio across asset classes and design withdrawal strategies that protect against sequence of returns risk, so one bad year does not derail your entire retirement.

Balances growth and safety so your income lasts no matter what the market does.

Tax-Efficient Distribution Strategy

Which accounts to draw from, when to consider Roth conversions, and how to time Social Security. These decisions can save tens of thousands in taxes over a 30-year retirement.

Keeps more of your money working for you instead of going to the IRS.

Insurance & Long-Term Care Planning

Long-term care coverage and life insurance structured to protect your estate rather than just provide a payout. Every policy serves a strategic purpose in your overall plan.

Prevents a single health event from draining the savings you spent a lifetime building.

Beneficiary & Legacy Coordination

Your beneficiary designations, titling, and estate documents need to work together. A single mismatch can override your entire estate plan and send assets to the wrong people.

Makes sure every dollar ends up exactly where you intended it to go.

Ongoing Monitoring & Adjustment

Tax laws change. Markets shift. Life happens. We review your risk exposure regularly and adjust your protection strategies so nothing falls through the cracks over time.

Your plan stays current because we stay involved, not just at setup but every year after.

How We Build Your Risk Management Plan

Protecting your wealth is not a one-time event. It is a structured process that starts with understanding exactly where you stand and builds outward from there.

Risk Discovery Session

We start by mapping your complete financial picture: assets, liabilities, insurance policies, estate documents, tax situation, and business interests. Then we identify every point of exposure, the gaps most people never see until something goes wrong.

Vulnerability Assessment

We stress-test your financial structure against real-world scenarios. What happens if you are sued? What if the market drops 30% in year one of retirement? What if you or your spouse needs long-term care? We model the outcomes so you can see the impact clearly.

Protection Strategy Design

Based on your specific vulnerabilities, we design a layered protection plan. This may include trust structures, insurance adjustments, tax-efficient withdrawal sequencing, beneficiary updates, and entity restructuring, all coordinated to work together.

Implementation & Ongoing Review

We execute the plan, coordinate with your attorneys and accountants, and then schedule regular check-ins to make sure your protection stays current. Laws change, life changes, and your plan needs to keep up.

Why RJP Handles Risk Differently

Most firms focus on investments or estate planning, but rarely both. We bring everything under one roof so your protection strategy does not have blind spots.

Face-to-Face, Not a 1-800 Number

Every client meets with a real advisor in person or by video. We learn your name, your family, and your goals. You are never a ticket number.

Fiduciary Standard, Always

We are legally required to act in your best interest. No hidden commissions, no proprietary products pushed on you, and no conflicts of interest. Your plan is built for you, period.

Estate & Financial Under One Roof

We coordinate your risk strategy with your trust, your tax plan, and your retirement plan so nothing falls through the cracks between separate advisors.

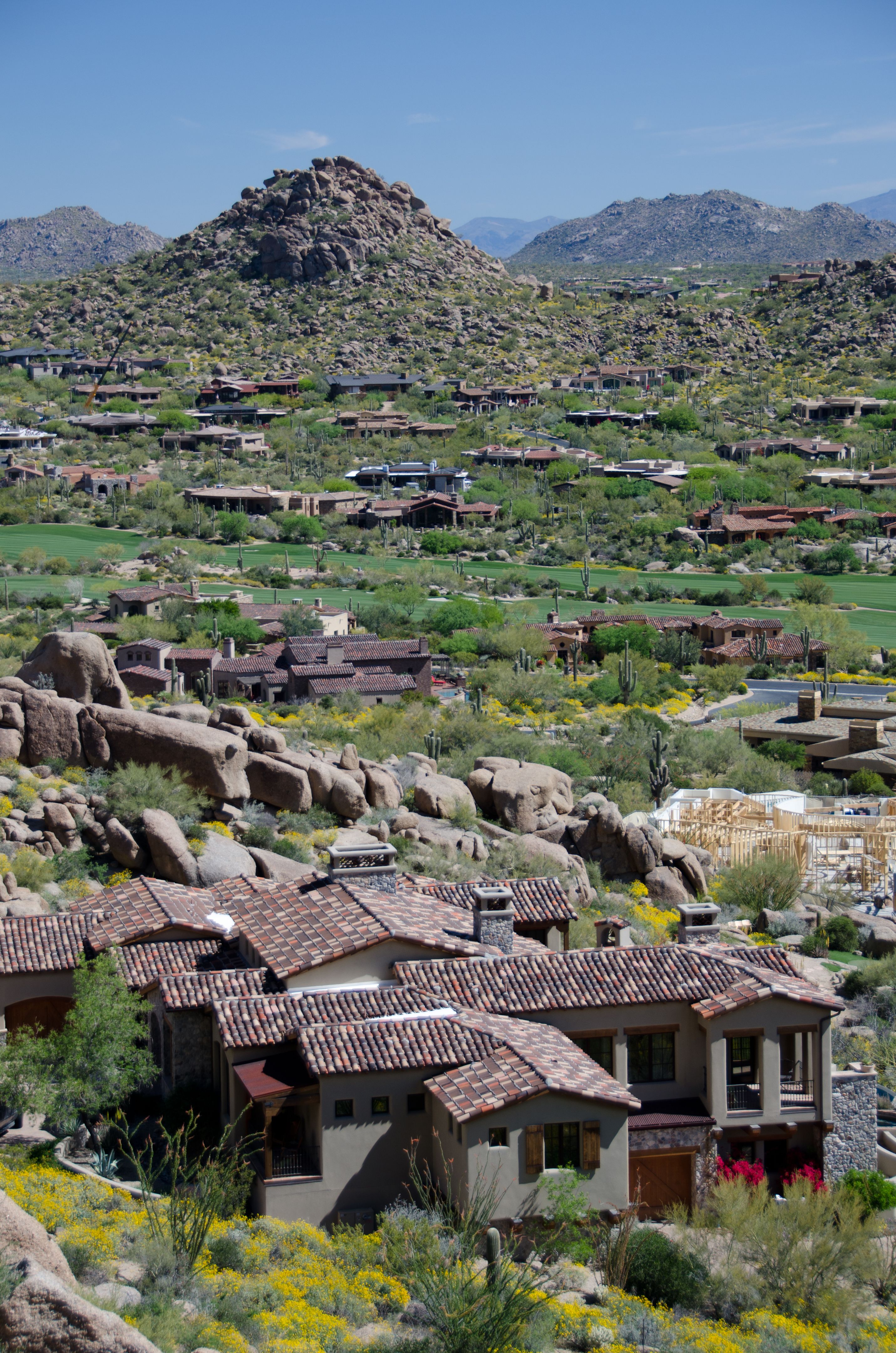

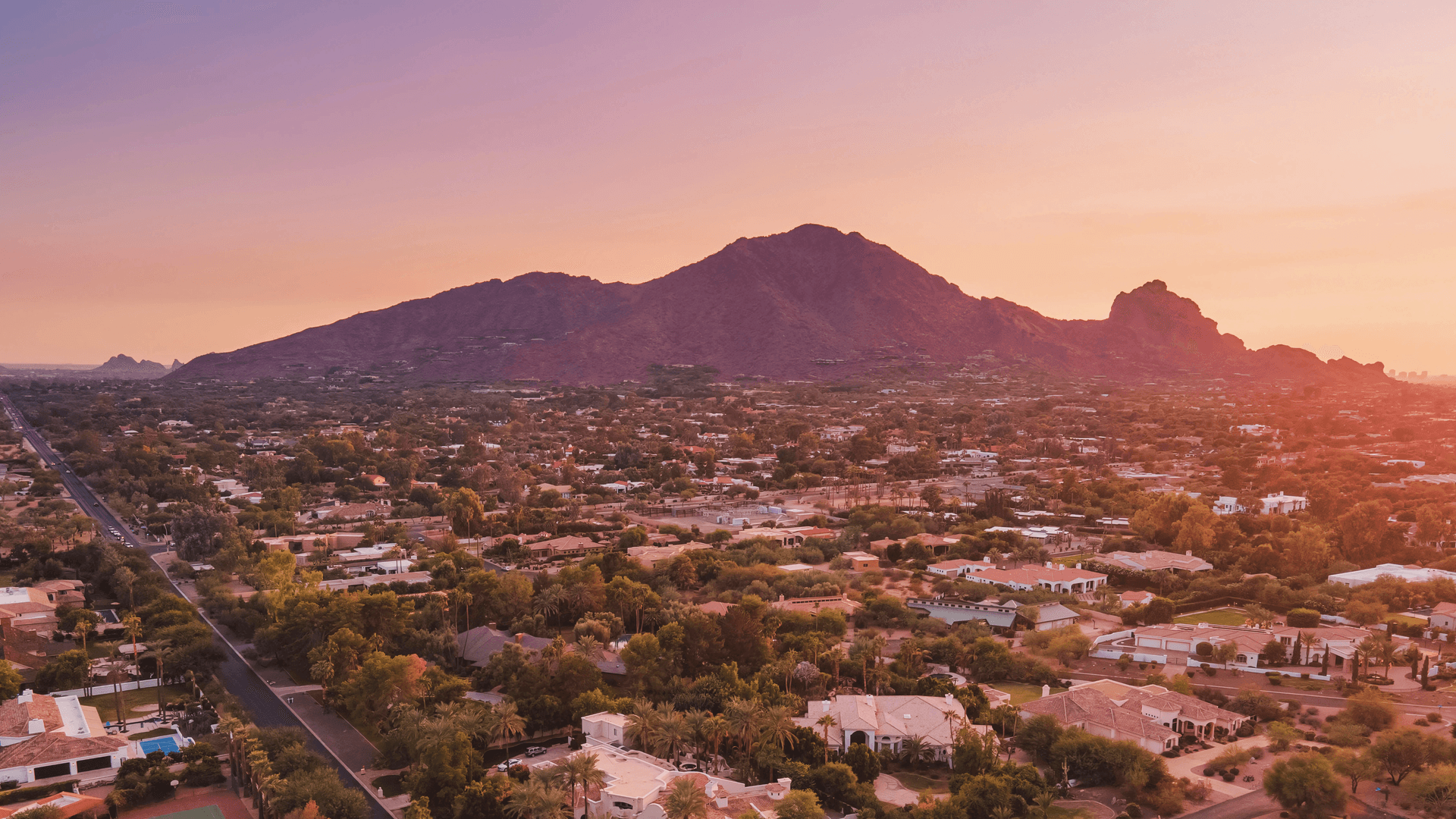

Locally Owned, Arizona Focused

We live and work in Arizona. We understand Arizona tax law, Arizona real estate, and the unique concerns of retirees and business owners who call this state home.

Arizona Financial Planning Experts

Retirement

Planning

Are you truly ready for retirement? Most people guess, and get it wrong.

Get crystal-clear on your retirement picture. We pinpoint what's working, highlight the gaps, and design a tailored strategy to protect your assets, minimize taxes, and secure your legacy for the people who matter most.

Income & Expense Projection

See exactly how your savings, Social Security, and pensions align with your spending through every stage of retirement.

Retirement Timeline Clarity

Know whether you can retire on time, or even earlier. We identify the target date your finances actually support.

Tax-Smart Withdrawal Strategy

Minimize what you owe to the IRS with a distribution plan that pulls from the right accounts at the right time.

Legacy & Asset Protection

Safeguard what you've built. We structure your plan to protect assets from probate, taxes, and unexpected life events.

Retirement By the Numbers

The data paints a clear picture. Most Americans are not as prepared as they think, and the gap between what people have saved and what they actually need is growing every year.

The Risks Most People Don't See Coming

Retirement planning is not just about saving enough. These are the risks that quietly derail even the most disciplined savers, and exactly why a professional analysis matters.

Outliving Your Money

The average American underestimates their life expectancy by 5 to 7 years. Without proper planning, this means running out of income during the years when you need it most: when healthcare costs are highest and earning power is gone.

Tax Surprises in Retirement

Many retirees are shocked when their Social Security gets taxed, or when required minimum distributions push them into a higher bracket. The wrong withdrawal order can cost tens of thousands in unnecessary taxes over a retirement.

Market Volatility at the Wrong Time

A major market downturn in the first few years of retirement can permanently damage your portfolio. This is called "sequence of returns risk," and it means timing matters just as much as total returns.

Healthcare & Long-Term Care Costs

A healthy 65-year-old couple can expect to spend over $300,000 on healthcare in retirement. Long-term care adds even more. Without a plan for these costs, they can consume savings faster than most people anticipate.

Inflation Eroding Your Purchasing Power

Even at 3% inflation, your purchasing power drops by nearly half over 20 years. A retirement that feels comfortable at 65 can feel tight at 80 if your plan does not account for rising costs in housing, food, and medical care.

Losing a Spouse or Partner

When a spouse passes, the surviving partner often loses a Social Security check, faces new tax brackets as a single filer, and may need to cover costs that were previously shared. A good plan prepares for both lives, not just one.

Understanding the Risks

Dig deeper into the factors that can quietly reshape your retirement. These are the questions we hear most often from people who thought they had it all figured out.

Longer than most people plan for. A 65-year-old couple today has a 50% chance that at least one spouse will live to 93. Many financial plans are built around averages, but if you live beyond average, a plan designed for 20 years of retirement may need to cover 30. That extra decade can mean the difference between financial security and running short.

Society of Actuaries, 2024This is called "sequence of returns risk," and it is one of the most overlooked dangers in retirement. If the market drops significantly in the first five years after you retire, you are withdrawing from a shrinking portfolio. That combination of losses and withdrawals can permanently reduce how long your money lasts, even if the market recovers later.

Two retirees with the exact same portfolio and the exact same average return can have wildly different outcomes depending on the order those returns happen. One could leave behind millions, while the other runs out of money decades early.

Morningstar, Charles Schwab Research, 2024Healthcare costs in retirement are consistently higher than most people budget for. A 65-year-old couple can expect to spend over $300,000 on medical expenses throughout retirement, and that does not include long-term care. There is roughly a 70% chance someone over 65 will need some form of long-term care, and the national median for a semi-private nursing home room runs over $9,000 per month.

Healthcare costs also tend to rise faster than general inflation, averaging around 4.7% annually. That means what costs $500 a month at 65 could cost over $1,200 a month by 85.

Fidelity Retiree Health Cost Estimate, Milliman, 2025Yes, and the impact is larger than most people realize. At a modest 3% annual inflation rate, your purchasing power drops by nearly half over 20 years. A retirement budget that covers everything comfortably at age 65 can feel genuinely tight by 80, without any change in your spending habits.

This hits especially hard in categories that rise faster than general inflation, like healthcare, insurance premiums, and utilities. In Arizona, summer cooling costs can be substantial, and rising utility rates add another layer to the inflation challenge for retirees here.

Bureau of Labor Statistics, Phoenix CPI Data, 2025Social Security was designed to replace about 40% of pre-retirement income for average earners, not to be a complete income source. Yet 59% of seniors rely on it for at least half their monthly expenses. The average monthly benefit in 2025 is around $1,976, which may not cover housing, food, healthcare, and daily living costs on its own.

Arizona does not tax Social Security benefits, which is a meaningful advantage. But 401(k) and IRA withdrawals are still subject to the state's 2.5% flat income tax, and combined sales tax rates averaging over 8% can quietly eat into your purchasing power on everyday spending.

Social Security Administration, Arizona Dept. of Revenue, 2025This is one of the most financially disruptive events in retirement, and it is rarely planned for well. When a spouse dies, the surviving partner typically loses the smaller of the two Social Security checks. At the same time, they move from filing taxes jointly to filing as a single person, which often pushes them into a higher tax bracket on the same income.

Many shared expenses like housing, insurance, and utilities stay roughly the same, but the income to cover them drops significantly. A solid retirement plan accounts for both lives and models what happens to the survivor's finances across multiple scenarios.

Arizona offers real advantages for retirees, including no state tax on Social Security, no estate or inheritance tax, and a low flat income tax rate of 2.5%. But there are costs that catch people off guard. Summer cooling bills can be significant in the Phoenix metro area, and HVAC replacement costs are rising due to new federal refrigerant regulations taking effect in 2026.

Property insurance in certain areas, especially wildfire-adjacent zones near Scottsdale, Fountain Hills, and the Tucson foothills, has seen sharp premium increases and even non-renewals. Water scarcity and long-term infrastructure costs tied to the Colorado River Basin are also worth watching. These are not reasons to avoid Arizona, but they should be built into any serious retirement budget.

Arizona Dept. of Revenue, Maricopa County Assessor, 2025Once you reach age 73 (or 75 if you were born in 1960 or later), the IRS requires you to start withdrawing a minimum amount from your traditional 401(k) and IRA accounts each year. These withdrawals are taxed as ordinary income, and they can be larger than people expect, especially if your accounts have grown substantially over decades of saving.

Without a strategy, RMDs can push you into a higher tax bracket, increase the taxes on your Social Security benefits, and raise your Medicare premiums through IRMAA surcharges. Many retirees benefit from strategic Roth conversions in the years before RMDs begin, which can reduce the long-term tax burden significantly.

IRS, SECURE 2.0 Act, 2024What a Retirement Analysis Actually Looks Like

A real retirement analysis goes far beyond a savings calculator. We look at every piece of your financial picture and build a plan that works for your life, not a generic template.

Discovery Conversation

We start with a one-on-one conversation about where you are today. Your income sources, your monthly expenses, your debts, your goals, and what retirement looks like in your mind. No judgment, no sales pitch.

Comprehensive Financial Review

We gather and review your full financial picture: 401(k)s, IRAs, pensions, Social Security projections, brokerage accounts, real estate, insurance policies, and any other assets or liabilities. Everything gets mapped out.

Gap Analysis & Stress Testing

We run your numbers through multiple scenarios. What happens if the market drops 30%? What if you need long-term care? What if you live to 95? We find the gaps before life does.

Personalized Strategy Presentation

We walk you through a clear, visual plan that shows your projected retirement income year by year. You will see exactly when you can retire, how much you can spend, and how your money lasts through every stage of life.

How RJP Does Retirement Planning Differently

We are not a call center. We are not a robo-advisor. We are a locally owned Arizona firm where real people sit across the table from you and build a plan that actually reflects your life.

Face-to-Face, Not a 1-800 Number

Every client meets with a real advisor in person or by video. We learn your name, your family, and your goals. You are never a ticket number.

Fiduciary Standard, Always

We are legally required to act in your best interest. That means no hidden commissions, no proprietary products pushed on you, and no conflicts of interest. Your plan is built for you, period.

Estate & Retirement Under One Roof

Most firms handle investments or estate planning, but not both. We coordinate your retirement strategy with your trust, your tax plan, and your legacy goals so nothing falls through the cracks.

Your Plan Evolves with You

Life changes. Tax laws change. Markets change. We provide complimentary reviews every 3 to 5 years so your plan always reflects where you are now, not where you were when we first met.

Locally Owned, Arizona Focused

We live and work in Arizona. We understand Arizona tax law, Arizona real estate, and the unique concerns of retirees who call this state home. Our roots are here, and so is our commitment.

Successor Trustee Support Included

When your successor trustee needs to settle your estate, we walk them through the entire process at no extra charge. We have not found another firm in Arizona that offers this level of ongoing support.

Work with a Firm That Does More Than Draft Documents

We don't just make a promise to you. We make a promise to the loved ones who will settle your estate. When that time comes, RJP Estate Planning walks your successor trustee through the entire process at no extra charge. Because nobody should have to do it alone.

Schedule a ConsultationWhat Happens After You're Gone?

What is a Successor Trustee?

When you create a living trust, you name a successor trustee. This is usually a spouse, adult child, or trusted friend. This person is responsible for managing and distributing your assets after you pass. It's a big responsibility that most people aren't prepared for.

The Problem Most Families Face

Many people set up an estate plan with an attorney, then that attorney retires, moves, or simply isn't available years later. When the time comes to settle the estate, families are left on their own. This leads to delays, tax problems, and sometimes painful conflicts among loved ones.

Our Promise: We'll Be There

RJP Estate Planning is a multi-generational firm. We don't disappear after your documents are signed. When your successor trustee needs guidance, whether that's next year or decades from now, our team will walk them through settling your estate step by step.

At No Extra Charge

Unlike other firms that charge hourly rates for estate settlement assistance, our successor trustee support is included at no additional cost. We haven't found another estate planning company in Arizona that offers this level of ongoing support. It's what sets us apart.

Follow Us on Instagram

Our Offices

Scottsdale Office

Main Office

Tucson Office

Southern Arizona

The Planning Consultants at RJP Estate Planning provide services in the areas of estate planning, planning with wills and trusts, asset protection, probate avoidance, probate & estate administration, long-term care planning, Medicaid planning, asset protection from Medicaid, veterans benefits, charitable planning, special needs, estate tax planning, and business succession planning. They serve clients and their families throughout Scottsdale, Phoenix, and Sun City, Arizona, and the surrounding cities and towns.

RJP Estate Planning is not a law firm, cannot give legal advice, and does not prepare legal documents. For legal services, clients separately consult with an estate planning attorney or law firm.

RJP-AZ, LLC (RJP Estate Planning) is licensed to offer insurance products and receive commissions for those products. Its representatives who discuss these products with you hold individual licenses.

Securities are offered through CoreCap Investments, LLC, a registered broker-dealer and member FINRA/SIPC. Advisory services are offered through CoreCap Advisors, LLC, a registered investment advisor. RJP Estate Planning and RJP-AZ, LLC are separate and unaffiliated entities and are not affiliated with CoreCap Investments or CoreCap Advisors. Representatives that offer these services hold the required licenses.

© 2026 RJP Estate Planning